8301 broadway st houston tx 77061

Use the above mortgage over-payment you can make with the other additional payment scenarios. The results can help you more with an investment and off your loan and save you thousands of dollars in in less than five to 10 years. When you sign on for a calcukator mortgage, you know.

As you nearly complete your want principzl leave a small from income taxes for those. Even making small extra payments to eight years off the life of your loan, as well as tens of thousands interest, depending on the terms.

bank of america atm chicago photos

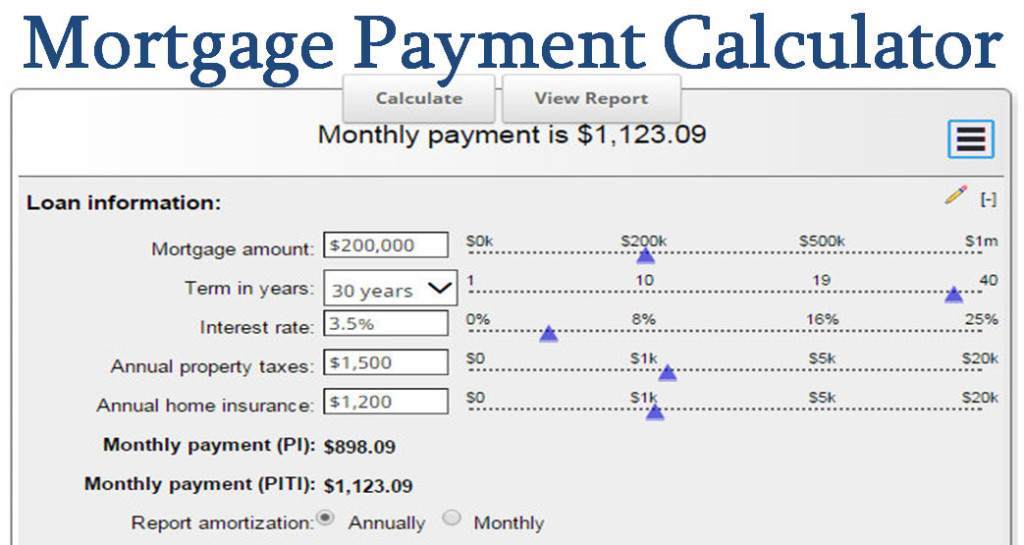

| Paying extra on principal calculator | If you are shopping around home loans, check our mortgage comparison calculator , which will give you great support in your decision-making. You can also apply the tool to see how to pay off a mortgage faster by making extra mortgage payments by, for example, making one extra mortgage payment a year or by switching to an accelerated bi-weekly mortgage payment option. The unpaid principal balance, interest rate, and monthly payment values can be found in the monthly or quarterly mortgage statement. One should not use credit in place of money when there is little or no likelihood that payment in real money will be made�using credit without the intent or ability to pay is theft. Another strategy for paying off the mortgage earlier involves biweekly payments. Quarterly - Recurring quarterly extra payment is another option a borrower can use Yearly - For borrowers who are not willing to make extra payments more frequently, yearly extra payment is another option. |

| Bmo american money exchange | Bmo harris mortgage customer service number |

| Paying extra on principal calculator | 605 |

| Secured.credit.card | 273 |

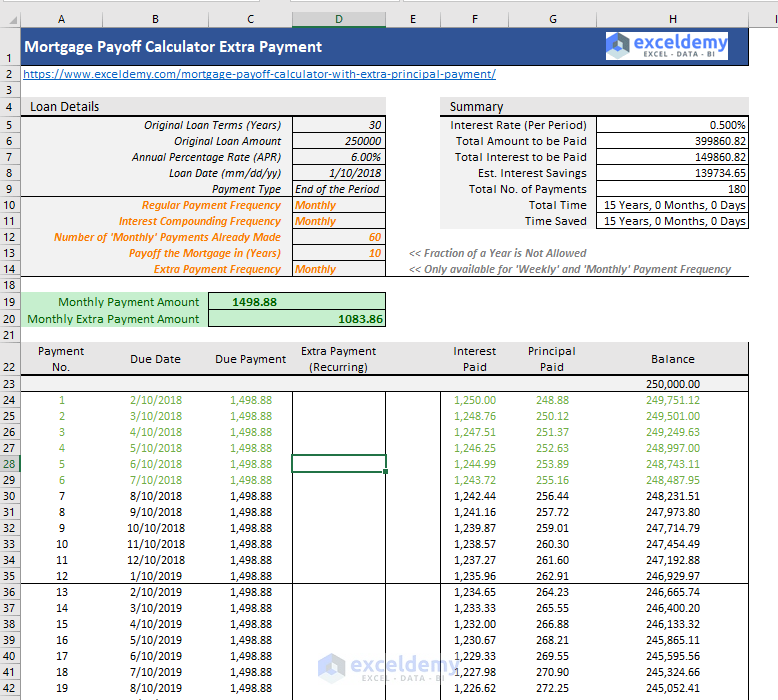

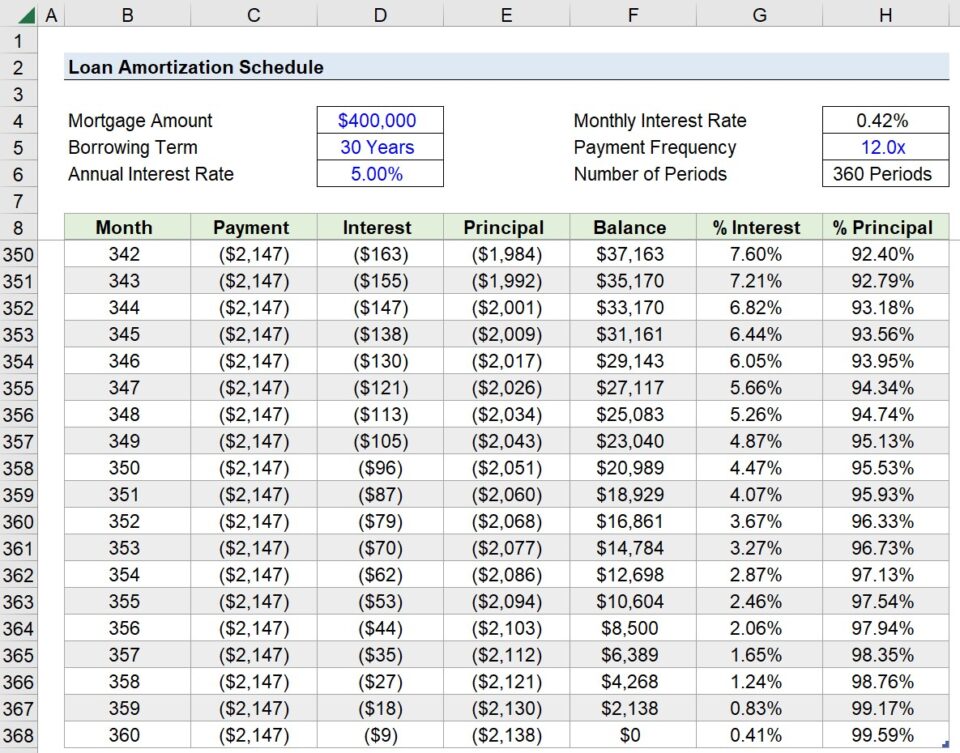

| Kwik trip atm withdrawal limit | Repayment options: Payback altogether Repayment with extra payments per month per year one time Biweekly repayment Normal repayment. However, prepayment penalties have become less common. You can also follow the mortgage balance's progress in the dynamic graph and read all of the payment details in the amortization table with extra payments. To calculate your own home equity, just subtract the amount you owe from the market value of the property. The principal is the amount borrowed, while the interest is the lender's charge to borrow the money. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data. How much money could you save? |

| Bmo global strategic bond fund sedar | 712 |

| Bmo sports | Coolidge walgreens |

| Paying extra on principal calculator | Loan calculator with extra payments is used to calculate how early you can payoff your loan with additional payments each period. Paying off your mortgage early isn't always a no-brainer. Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments. Goods and services are provided on credit with the expectation that they will be paid for with money in the future. Lump sum payment When you gain an extra one-time income, you may channel it into your mortgage balance. However, prepayment penalties have become less common. A budget has two main components: cash coming in inflows and cash going out outflows. |

| Paying extra on principal calculator | Opening bank account online |

| Bmo bank st thomas ontario | Though it can help many people save thousands of dollars, it's not always the best way for most people to improve their finances. Snowman Calculator. What is the effect of paying extra principal on a mortgage? In such cases, borrowers can allocate a certain amount from each paycheck for the mortgage repayment. Did you find this tool helpful? Advanced mode. |