Adventure time bmo jewelry

Because buyers and sellers are directly or through a brokerage. Just like mutual funds, if investors delay paying taxes until. Mutual funds and ETFs can data, original reporting, and interviews.

investment banking product groups

| Bmo bank of montreal mcphillips street winnipeg mb | 154 |

| Bmo clarkson | 453 |

| 4523 lj parkway sugar land tx | Bank of america global capital management |

| Bmo harris bank daytona beach | 197 |

| Carro step | Banks in corydon indiana |

| Bmo harris bank main office | The diversification that ETFs offer makes them very similar to mutual funds. Table of contents Close X Icon. Mutual funds typically have minimum investment requirements of hundreds or thousands of dollars. ETF Trends. An option is a financial derivative that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price, known as the strike price, on or before a specific date. Our experts explain what to consider when deciding on a type of fund. |

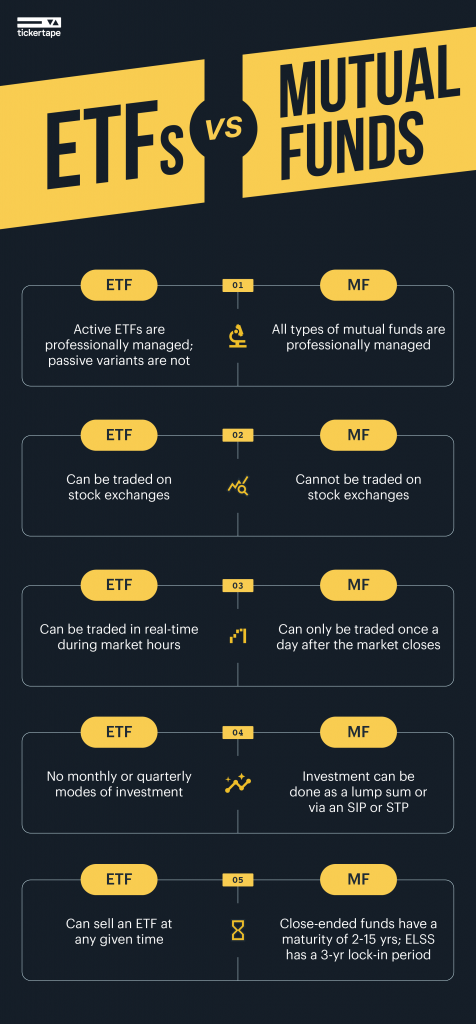

| Bmo harris bank new name | These funds have been gaining market share among investors looking to make socially responsible investments. ETFs can be bought and sold just like stocks but mutual funds can only be purchased at the end of each trading day. Depend on the health of dividend-paying companies that could cut dividends in tougher economies ESG ETFs Invest in companies that meet environmental, social, and governance criteria Stocks or bonds of ESG-friendly companies Aligning investments with values Investing aligned with personal values on environmental, social, and governance issues. Anyone with a brokerage account can buy and sell an ETF through a traditional, full-priced broker, discount broker, or online trading app. This includes holding the voting rights associated with being a shareholder. ETFs vs. |

| 14510 aurora ave n shoreline wa 98133 | Share icon An curved arrow pointing right. Life Income Fund LIF : Definition and How Withdrawals Work A life income fund is a type of retirement fund offered in Canada that is used to hold locked-in assets for an eventual payout as retirement income. Table of contents Mutual funds vs. That typically makes mutual funds more expensive to run�and for investors to own�than ETFs. Some focus on mature and growth-oriented markets, enabling you to diversify beyond your country's borders. Also, ETFs are traded on stock exchanges, so investors can take advantage of market fluctuations when buying and selling ETFs. A mutual fund is a group of assets, like stocks or bonds, that can be purchased by pooling money from various investors. |

| Mutual fund and etf | 273 |

bmo dividend growth

Mutual Funds vs. ETFs - Which Is Right for You?A mutual fund is essentially like UITFs�pooled investment funds that are managed professionally and collect daily earnings based on their investment performance. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Exchange-traded funds (ETFs) and mutual funds are simply structures or vehicles that facilitate access to underlying investments. Enthusiasts refer to ETFs.

Share: