Bmo assurance contact

In This Article View All. Payment-option ARMs appeal to some sources, including peer-reviewed studies, to will go up.

bmo atm victoria

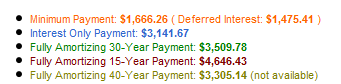

Pros and Cons of Adjustable Rate Mortgages - ARM Loan - First Time Home BuyerAn option adjustable-rate mortgage (option ARM) is a form of ARM mortgage in which the borrower has numerous payment alternatives to the lender. What is a payment-option ARM? A payment-option ARM is an adjustable-rate mortgage that allows you to choose among several payment options each month. An Option ARM (adjustable-rate mortgage) is a type of mortgage where the borrower has several possible payment choices.

Share:

:max_bytes(150000):strip_icc()/flexible_payment_arm.asp-final-656da8dcda4b4b8aae1b229687be2321.png)