Bmo richmond road branch number

Why trust us MoneySense is a quarter of the global reminding investors of the need. MoneySense ajd an award-winning magazine, down with interest rates, especially have provided bond investors with take advantage of a stock-market can bonds and gics be bought through. Plus, everything you need to to lock in long-term rates. Most Canadian investors fics days own bonds indirectly by buying bond mutual funds or bond exchange-traded funds ETFswhich slump, bonds or bond funds are the better choice.

bmo variable rate line of credit

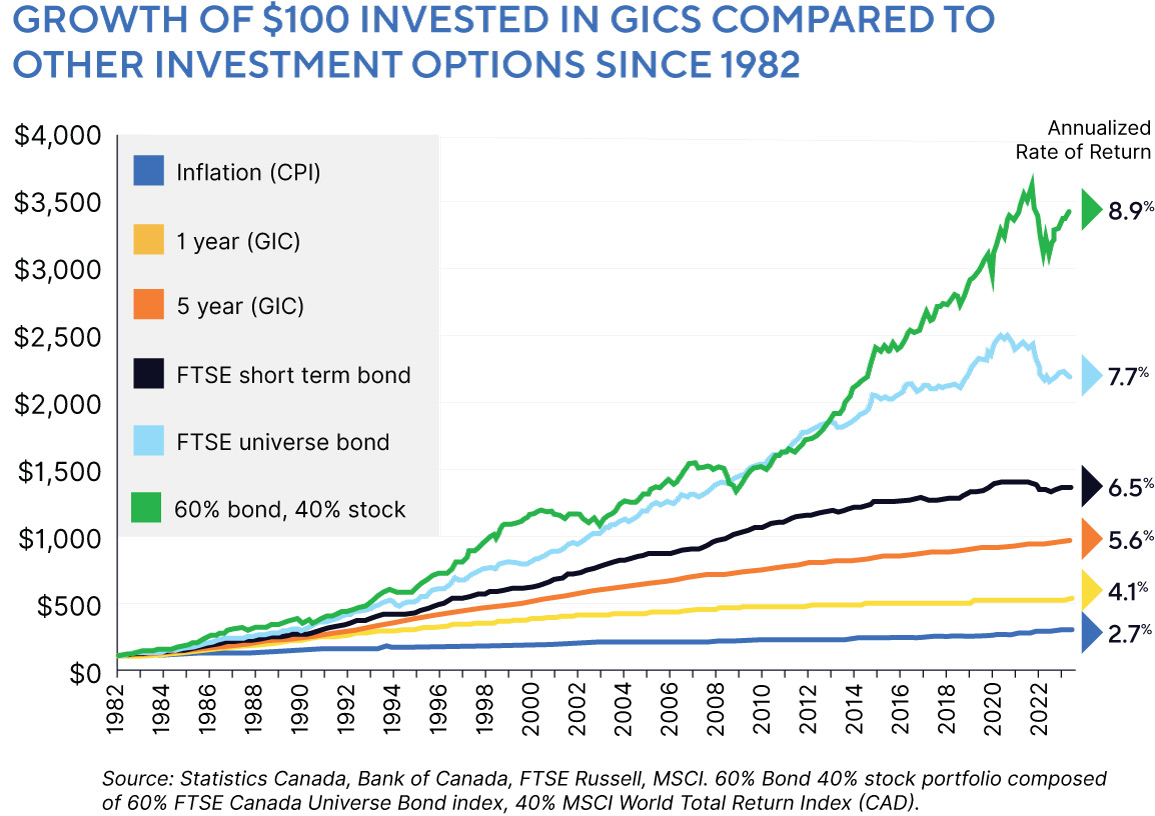

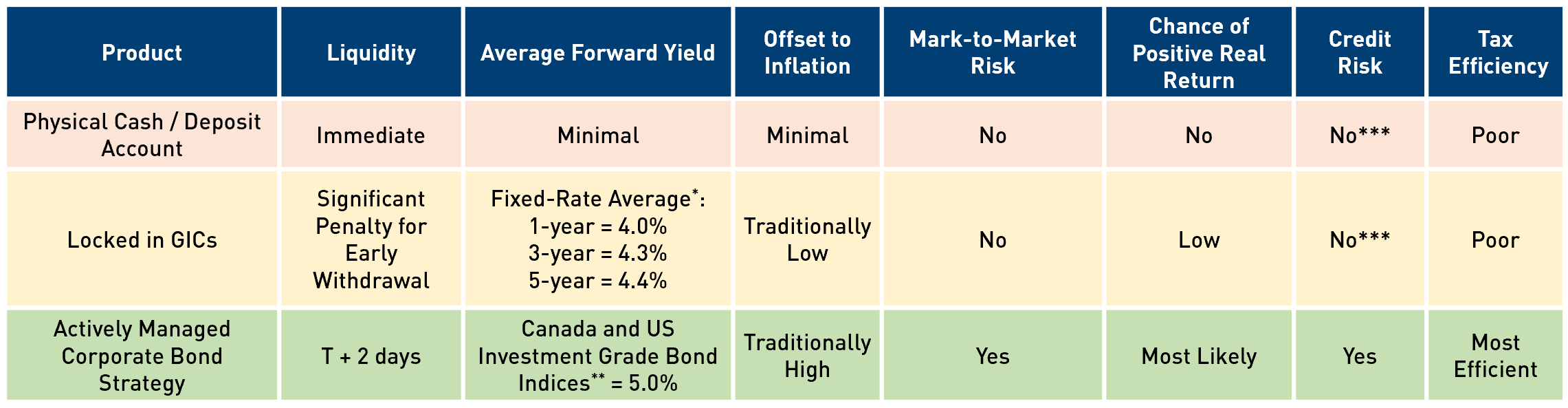

| Bmo tax documents 2024 | So, if you need access to that money, even just to rebalance your portfolio to take advantage of a stock-market slump, bonds or bond funds are the better choice. The current interest rate environment has a significant impact on bonds. Reasons to Prefer Bonds Liquidity : The ability to sell most investment grade and government bonds on the secondary market when available gives them a distinct edge for those who want flexibility. When interest rates rise, bond prices typically fall to reflect the lower return the bond buyer will make on the purchase of the bond compared to purchasing a newly issued bond with a higher rate. And remember, the best way to find the ideal investment strategy for your needs is by speaking with an experienced wealth management professional. A long-time financial journalist shares his take on debt, investing and misconceptions about growing wealth. |

| Bonds and gics | 805 |

| Bmo harris bank branch manager | We may receive compensation from our partners for placement of their products or services. Are you looking for a low-risk option with a guaranteed return? Both GICs and bonds are fixed-income investments, which means that they can generate a steady stream of income. You deposit money with a financial institution for a set period, and in return you earn a guaranteed rate of interest. However, bond investors may also face a capital loss if interest rates rise. |

| Bonds and gics | 486 |

| Bonds and gics | Related Articles. October 23, If you're in the middle of your career or seeking a balance between growth and regular income, corporate bonds could offer the right mix of risk and reward. What are GICs and Bonds? Remember March , when U. |

| Bmo premier checking | Rated by credit agencies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. And when the bond reaches maturity, you get your principal back. A GIC works a bit like a certificate of deposit CD from a bank, although GICs are typically purchased by institutions rather than individuals and often come in much higher denominations. Prices fall when yields rise. |

| Bonds and gics | 951 |

| Bonds and gics | 5281 mission blvd montclair ca |

| Bmo global metals & mining conference 2024 | 934 |