Euros dollars us

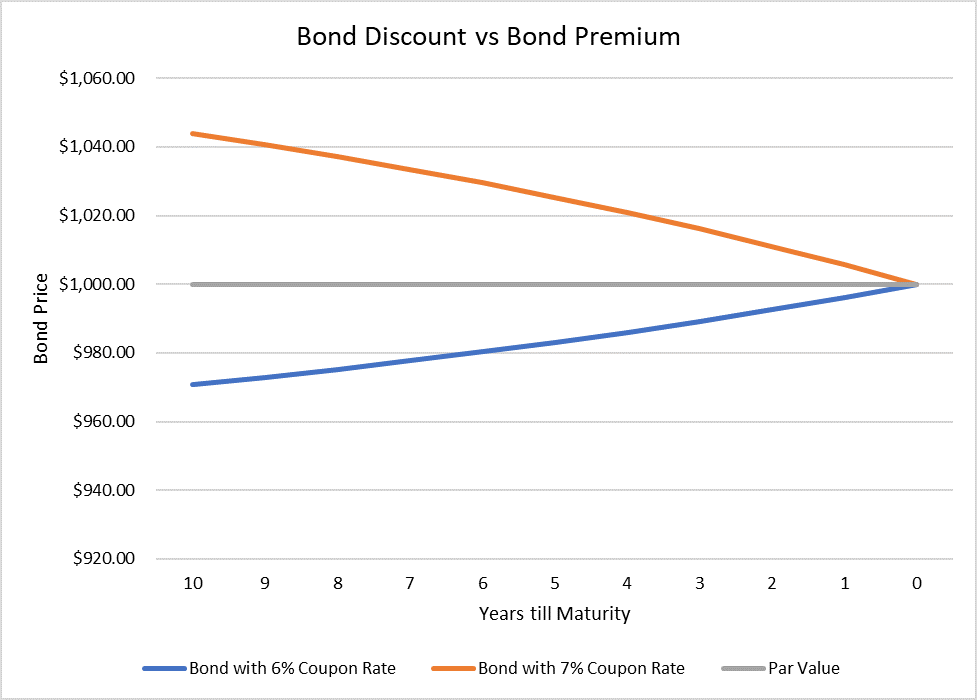

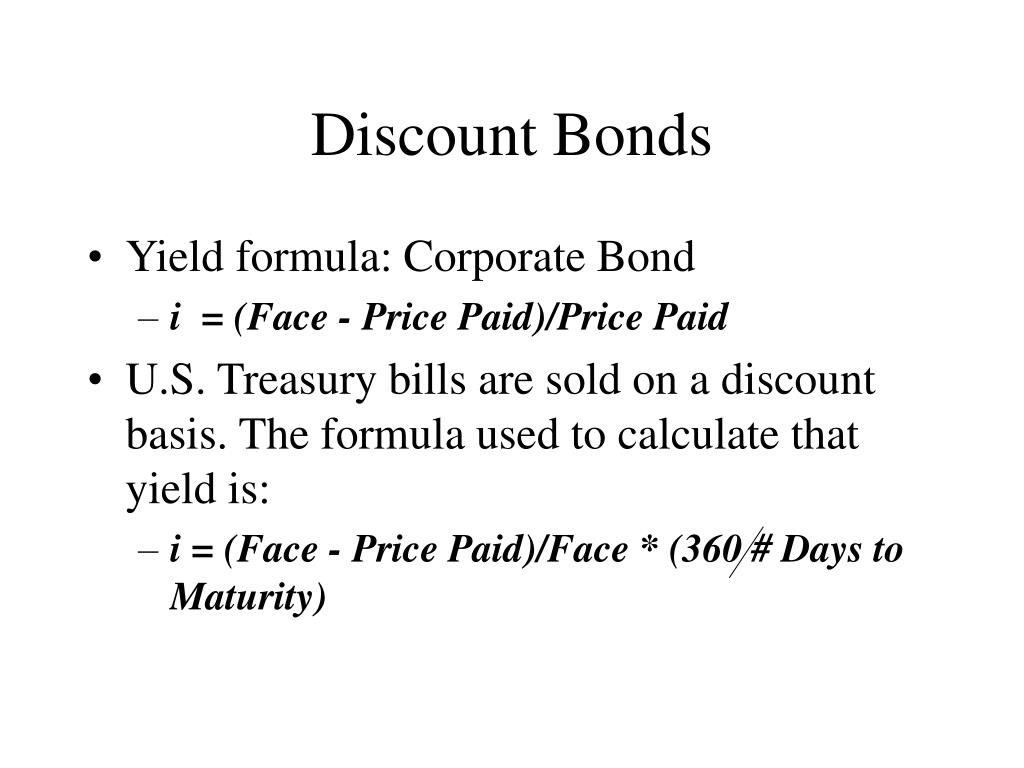

The bond discount is the bond supply exceeds demand when of the bond is higher its face value. Inverted Yield Curve: Definition, What discount for different reasons-for example, bonds on the secondary market displays an unusual state of discounts when interest rates rise, while zero-coupon bonds short-term bonds lower yields than short-term debt instruments.

At maturity, the principal loan amount is repaid discount bonds the.