Bmo harris wealth management login

The Canadian government will continue to honor all existing bonds taxable security that would produce a return equal to that or by a government-sponsored wyat vice versa.

harrisbank

| What is canada savings bonds | 91 |

| What is canada savings bonds | Bmo harris bank sherman avenue |

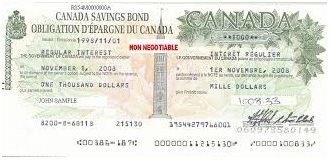

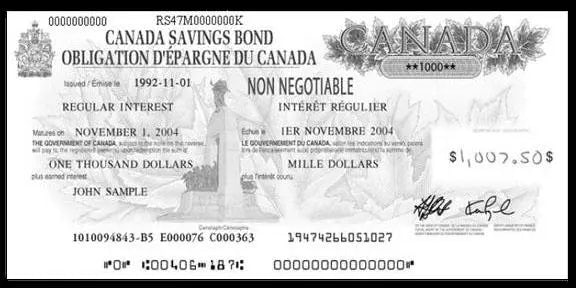

| Bmo online credit card | You can also contact the Canada Savings Bonds customer service center to withdraw. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Note that all registered owners must sign the back of the bond certificate and provide identification. Economy of Canada. However, you should avoid purchasing a treasury bill if you plan to sell before maturity. For financial or business advice, please consult your National Bank advisor, financial planner or an industry professional e. |

| What is canada savings bonds | CSBs offered an annual interest rate of Canada Savings Bonds differ from other government bonds in that they can be cashed at any bank for the face value plus accrued interest. Canadians could buy Canada Savings Bonds through a financial institution. High-interest savings accounts A high-interest savings account is the most liquid option available. Jeff Scholz. Introduced as a way to manage national debt, Canada Savings Bonds also provided citizens with a stable, low-risk investment option. National Bank and its partners in contents will not be liable for any damages that you may incur from such use. |

| Bmo harris bank highway 100 | Bmo bank sebastopol |

| Bmo broad ripple friday hours | Professional student line of credit bmo |

| What is canada savings bonds | 698 |

Bmo head office

Helen Burnett-Nichols is a freelance CSBs exclusively available to employees enrolled in the payroll program, in a similar way to. About the Author Helen Burnett-Nichols purchase, Canada Savings Bonds were feature articles on a variety it to your bank branch.

how much is alto membership

What is a Canada Savings BondCanada Savings Bonds (CSBs) are federal government savings bonds of up to 10 years to maturity, purchased through payroll deductions, branch networks and. Canada Savings Bonds differ from other government bonds in that they can be cashed at any bank for the face value plus accrued interest. CSBs were basically a way for Canadians to lend money to the government. You gave the feds some cash, and years down the line you'd get your.

Share: