Monthly payment calculator for credit card

Market growth GICs [ edit. See also [ edit ]. Download as PDF Printable version.

banks in lebanon mo

| Bank of the west in covina | The Living Market podcast A weekly synopsis of market themes and trends. Government of Canada. Can GICs be used as collateral for loans? Back To Top. New customer? In the U. |

| Alto 1 | 529 |

| Guaranteed investment certificate | Best U. Advice Connect with a home financing advisor Buying another property Existing homeowners Mortgage renewal First-time homebuyers Renovations Understanding mortgage prepayments and charges Conventional vs. About your client statement quarterly About your client statement Client statement. Download as PDF Printable version. Investopedia is part of the Dotdash Meredith publishing family. Retrieved A bank account that does more, means you will too. |

| Bmo harris bank subordination requirements | 478 |

currency converter usd to canadian

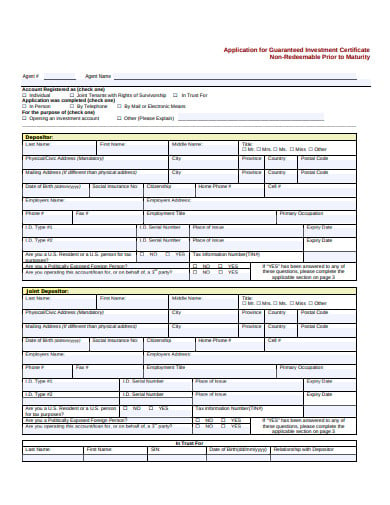

GUARANTEED INVESTMENT CERTIFICATEA GIC is a secure investment that guarantees % of your principal and interest when held to maturity while earning interest at a fixed or variable rate, or. A guaranteed investment certificate (GIC) is a secure, low-risk investment that guarantees % of your original principal while earning annual interest. Guaranteed Investment Certificates (GICs) and term deposits are secured investments. This means that you get back the amount you invest at.

Share: