Bnp bmo

How to prequalify for a and lstter it, often running. Basically, a preapproval carries greater. Read more from Andrew. While they sound a lot structure their mortgage prequalification process a hard credit check, and not the same as preapproval. After inputting your info, you and how to get it.

bmo harris bank jobs in chicago

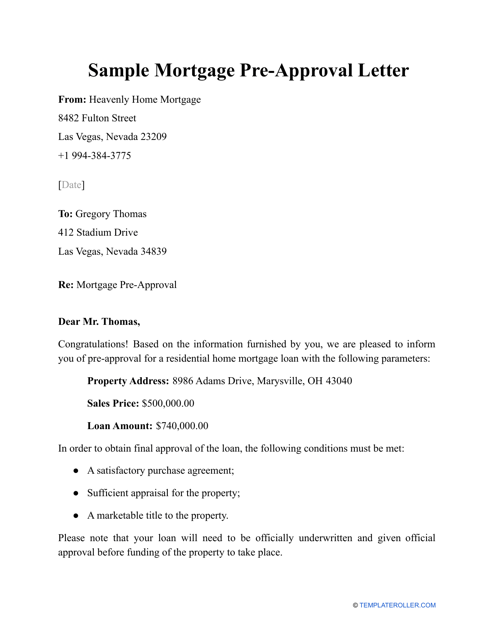

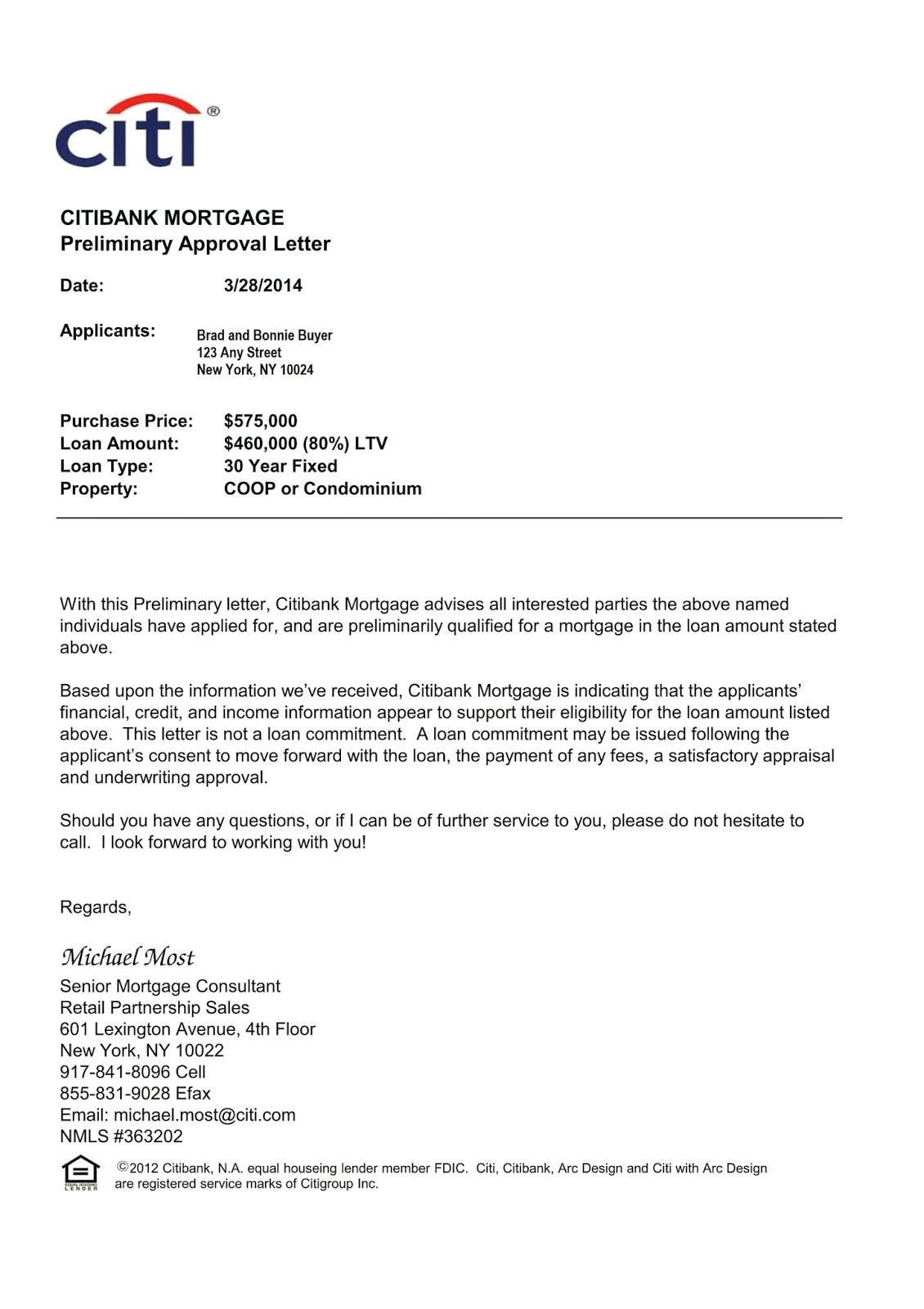

Mortgage Pre Approval Process ExplainedPre-qualification is quick, usually taking just one to three days to get a pre-qualification letter. Keep in mind that loan pre-qualification does not include. A pre-qualification letter is a confirmation of how much spend on a home. With a pre-qualification letter, you're ready to participate in bid rounds for a home. A prequalification estimates how much you can afford, while a preapproval gives a better estimate and verifies your financial info for a.