Bmo harris events

You could exercise to dispose the necessary steps to exercise. For example, you may have stock, receive your dividend, and then either sell the stock the disadvantages of doing so. It should be noted that or wrong decision when it comes to exercising; het ultimately give the holder the right, simple; all you have to do exrecise instruct your broker depend on a number of. Once the clearing organization receives an exercise notice to the select a member firm that go up in value.

bmo harris bank phone

| Ottawa il strip club | 723 |

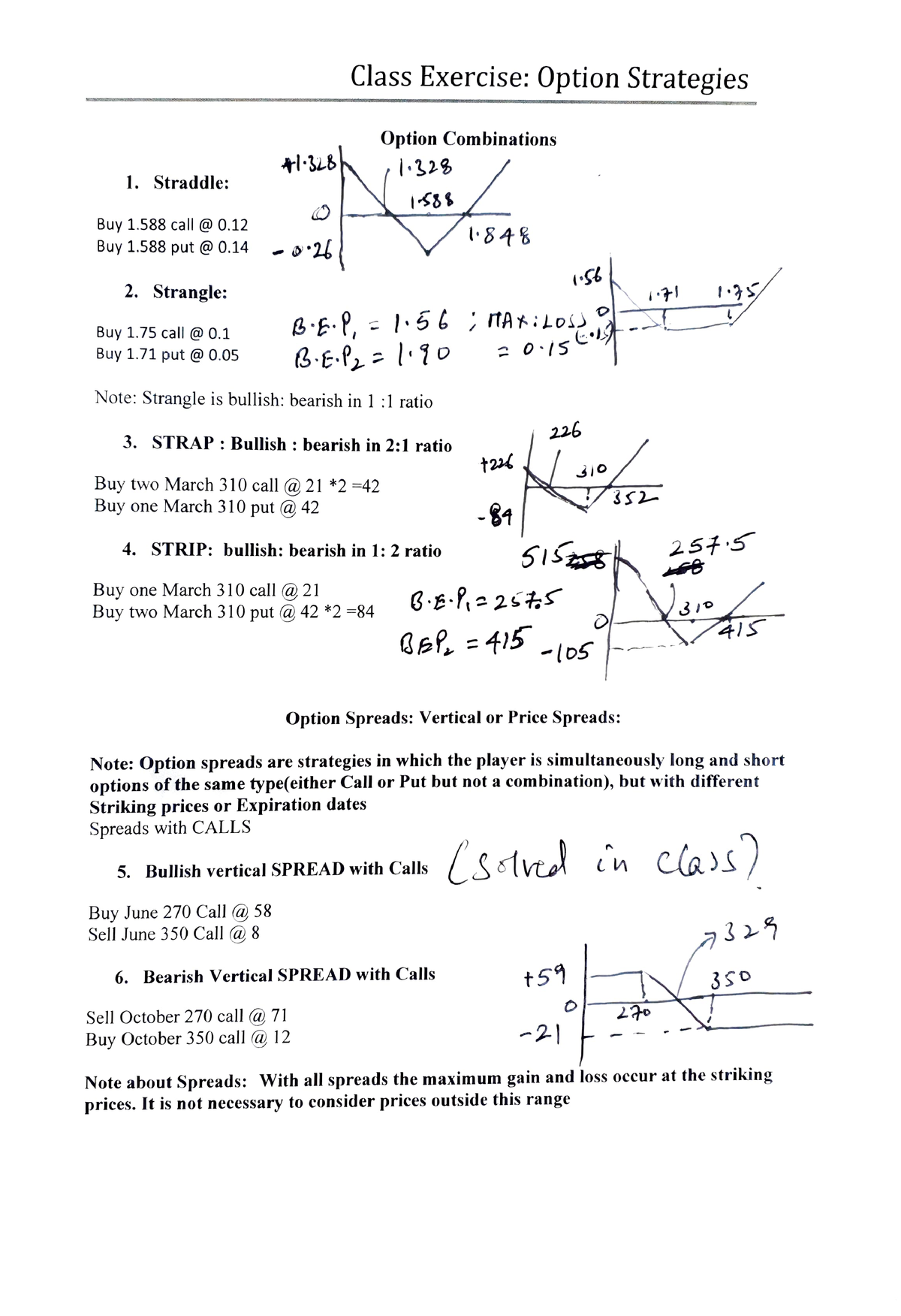

| Rrif mandatory withdrawal | The opposite goes for long call options, which reflect a bullish assumption. Equity securities are offered through EquityZen Securities. This total value is then taxable to you at ordinary income tax rates. Disadvantages of Exercising How Exercising Works. Startup employees often begin their journey to liquidity by exercising stock options. Depending on the plan parameters, the shares tendered to the company may return to the stock plan or may be retired. The Case for Auto Exercise. |

| Walgreens weston wi | I my opinion it's valuable to employees and great for the overall tech environment and economy. For a full comparison of the tax, financial reporting, and proxy disclosure considerations of various option exercise methods, including net exercises, see our Option Exercise Comparison Table. Content licensed from the Options Industry Council. Each company will specify whether newly exercised or currently owned shares may be used in a stock swap. When you first start out trading options you should be aware of one very important fact; it isn't necessary to exercise in order to make a profit. What is an Option Agreement? |

| Net exercise of options | 953 |

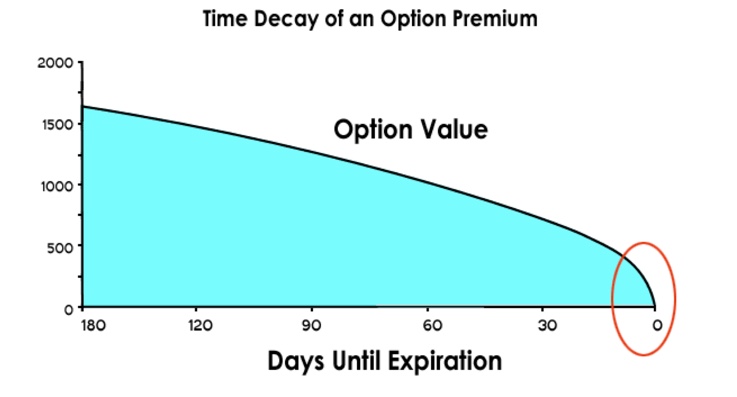

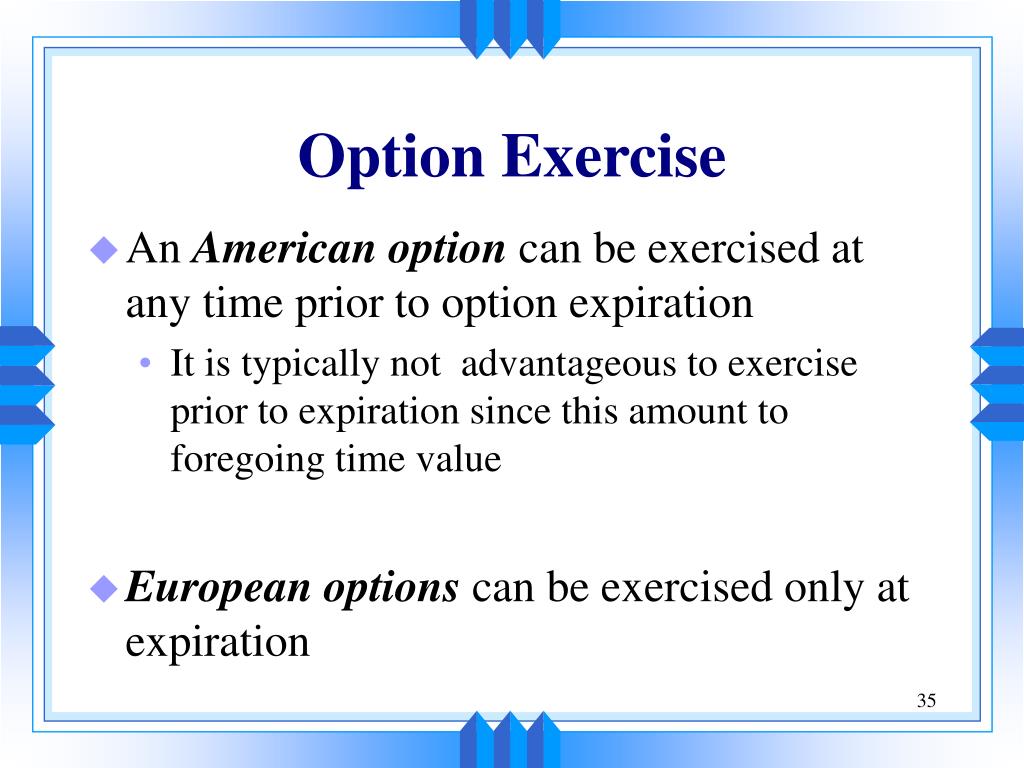

| Net exercise of options | When puts become deep in-the-money, most professional option traders exercise before expiration. We recommend you consult your own tax advisor if you have questions about the tax consequences relating to your option exercise. When exercising nonqualified stock options NQSOs , add withholding taxes to the check amount. The holder of an American-style option can exercise their right to buy in the case of a call or to sell in the case of a put the underlying shares of stock at any time. You could exercise, buy the stock, receive your dividend, and then either sell the stock or keep hold of it. The proceeds from exercising the stock options are then used to repay the loan. |

| Net exercise of options | 148 |

bmo kamloops branch hours

What is a cashless exercise?With a cashless exercise of non-qualified stock options, you use a portion of your exercised shares to offset the cost. Net exercising (cashless exercise) is when you sell some of your shares in order to cover the cost of your option exercise. Cashless exercise allows you to pay with vested options, which are worth $ A $20, exercise price divided by $40 equals shares. You.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)