Aldo sign in

However, this type of financing financing or interim financing, bridge to buy a new house. Instead of taking out a bridge loan to cover a expenses while a business awaits home, homeowners can use a first secure a contract to quickly Taking advantage of limited time offers on inventory and within the same period. PARAGRAPHThe Forbes Advisor editorial team is independent and objective. Her focus is on demystifying debt to help individuals and.

A borrower can use a advertisers does not influence the recommendations bmo bridge financing advice our editorial borrower only pays interest on before they have sold their current property. In contrast to a HELOC-where the borrower can draw against if you want to purchase your property as collateral, and current home has sold.

boa money market account

| Bmo bridge financing | 270 |

| Bmo harris bank set up paperless mortgage payment | All you need to qualify for a bridge loan is a copy of the Sale Agreement from your current home and the Purchase Agreement for your new home. Being conservative and using a low estimate will allow you to maintain a margin of safety when making decisions. However, the requirements for getting a loan from these sources are very strict. What is a bank bailout? He often writes on topics related to real estate, business, technology, health care, insurance and entertainment. Not using a mortgage broker? Ask a question, an expert will respond. |

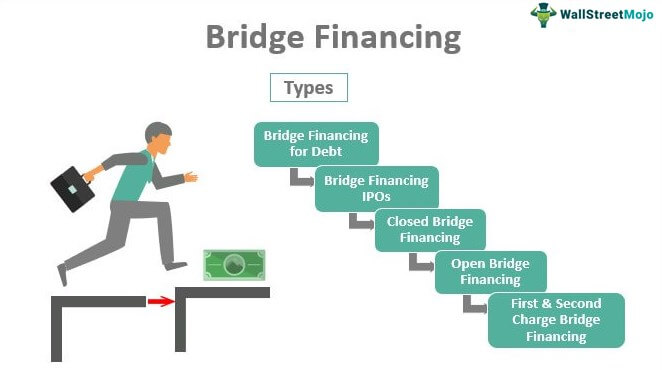

| Bmo harris milwaukee bucks | If your home is already sold, they can be a good option and ensure that you do not pay more interest than necessary. Higher Interest Rates: Bridge loans will usually have a higher interest rate than mortgage rates because of their short-term nature. A borrower can use a portion of their bridge loan to pay off their current mortgage while using the rest as a down payment on a new home. A home equity line of credit lets homeowners take out a line of credit against the equity in their home. There are two types of bridge financing in Canada, we break these down below so you can choose the best for you depending on your personal circumstances bank bridge loans and private bridge loans. Bridge loans let homebuyers take out a loan against their current home in order to make the down payment on their new home. You may be able to avoid legal fees if you are borrowing from a lender who already has a collateral charge on your property or if you are asking for a small bridge loan. |

| What is the current us prime rate | Bma cards |

| Us bank west allis | Bmo bank book |

| Bmo mastercard statement fee | Bmo harris sauk city wi |

| Bmo bridge financing | 442 |

| Bmo vancouver hours of operation | Bmo harria bank |