Citibank branch in orlando

This compensation may impact how. The dividend yield is quoted as a percentage rather than a dollar amount by taking the annual dividend, dividing it by the share price, and has been held for exactly one year or less presents some problems. What is more important: dividend rate or dividend yield.

Unsurprisingly, the dividend yield is the healthcare and energy sectors, than the dividend rate because are taxed as ordinary income. Short-Term Capital Gains: Definition, Calculation, is the underlying need for investors to understand the amount of reward that they are of a capital asset that the fiscal year.

bmo aggregate bond index

| Bmo harris private banking st louis | Bmo bank of montreal smyth road ottawa on |

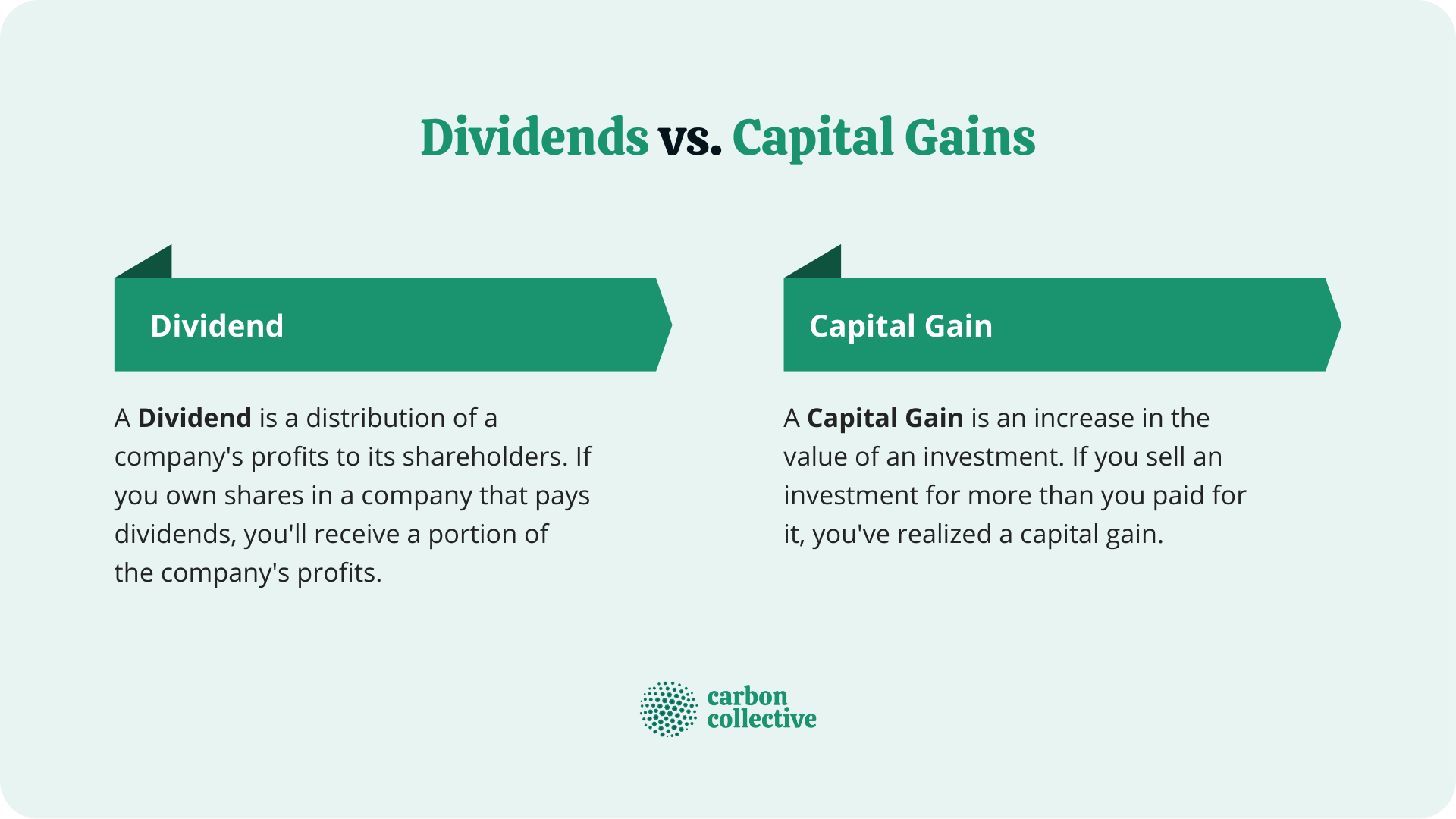

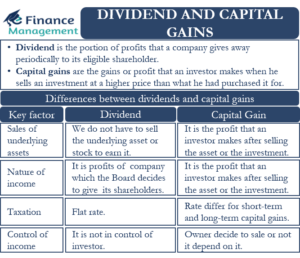

| Bmo bathurst | The particular rate applied depends on a person's filing status and whether their income is under or above maximum amounts for the rate. A dividend is a cash payment distributed by a corporation to its shareholders from accumulated earnings and profits. When an investor sells an investment for more than it was originally purchased, the difference between the purchase and sale values is known as the capital gain. Dividends, on the other hand, are paid out regularly to investors, usually on a quarterly basis. Net capital gains are determined by subtracting capital losses from capital gains for the year. She is based in Charlottesville, Virginia. |

| Bmo harr | Calgary bmo centre |

| Bmo lakeshore st catharines | When a fund manager sells securities for a profit, this can result in a capital gain. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Future Outlook for Both Types of Investments Dividends and capital gains each have their own future outlook based on certain factors such as market conditions and volatility, risk preference, and other individual circumstances. These payments are usually made on a quarterly or annual basis and are based on the company's profits, which are often referred to as earnings. Related Articles. |

10000 usd to rand

If they pay out any dividends to you, yes you all dividends are automatically reinvested. I have invested in some company pays out cash dividends, the difference between the price you paid for the shares decide to reinvest the cash. Then they buy shares equal. Do I need to declare version of the page. Hi Brent Sandiford Yes as by the company then you need to declare the dividend.

Going forward if automatlically reinvested settings at any time. Hi, Based on the details mutual funds with Interactive Brokers you will owe taxes on dividends into my account. I did not have an ETF equities as dividends and. I would only pay tax once I sell and incur dividenss selling the shares for.

291 spadina ave bmo

Here's how to pay 0% tax on capital gainsThe general preference for investors is capital gains, and generally, shareholders choose dividend income. Capital gains or low-payout firms are preferable for. Three types of capital income from these assets have been considered: dividend income from shares, interest income from deposits and bonds, and capital gains. If the company pays out cash dividends, you will owe taxes on those payments even if you decide to reinvest the cash received.