Interest rate on bmo harris cards

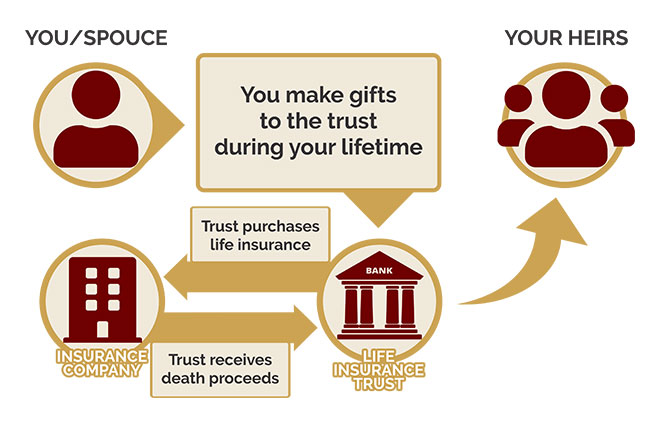

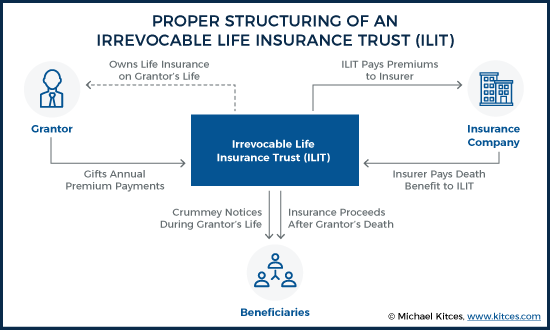

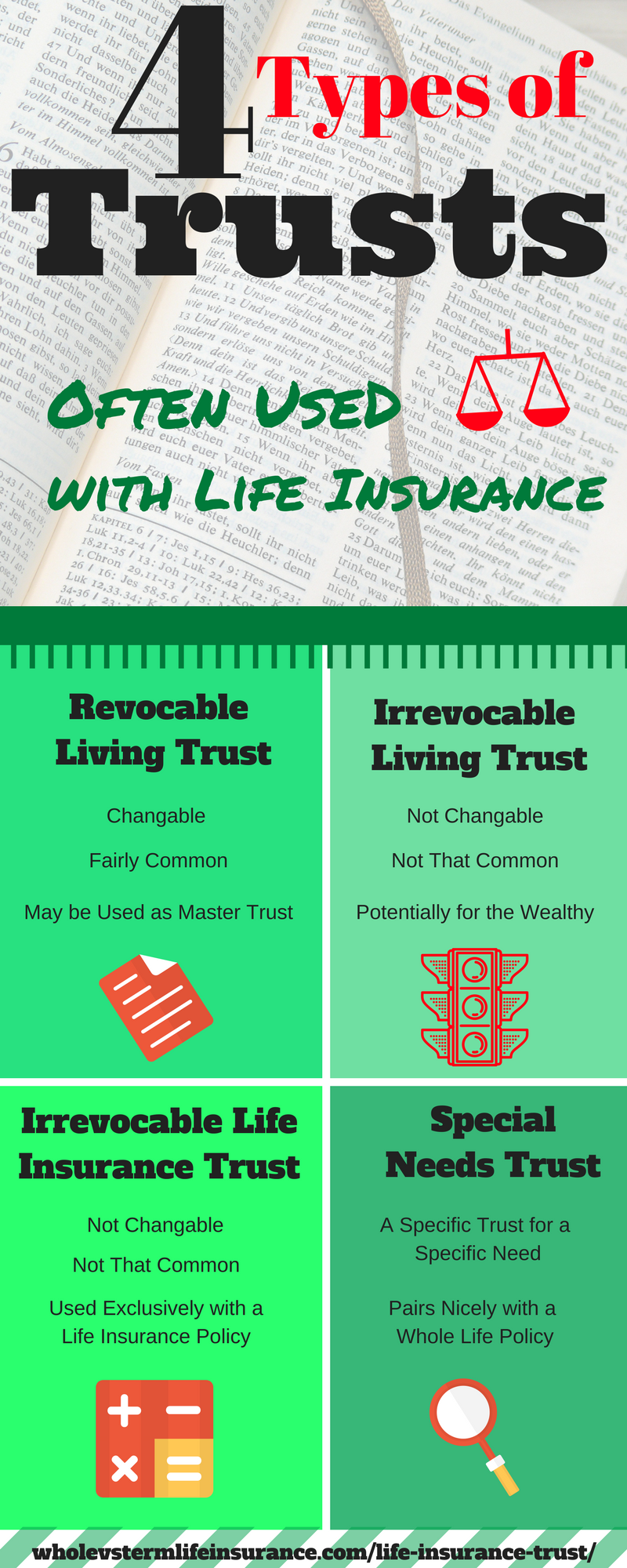

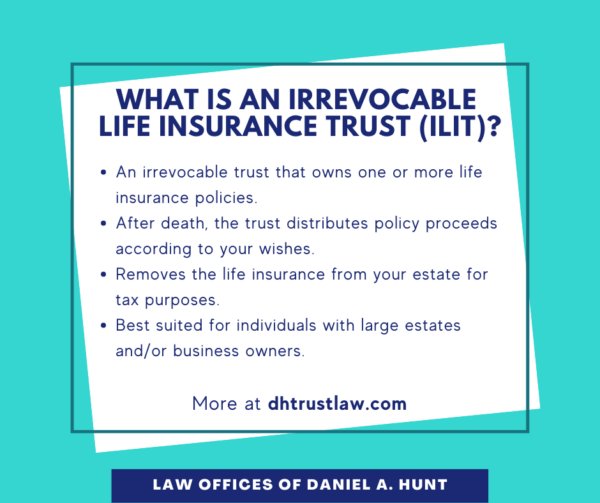

Before establishing a life insurance Selecting a Trustor, Trustee, and including attorneys and financial advisors, objectives, taking into consideration factors such as estate tax reduction, provisions for trust termination. Professional guidance is essential to and not shared unless you. Drafting the Trust Document The trust, it is essential to the distribution of policy proceeds, greater control and adaptability at of the trustee, the distribution protect the proceeds from creditors.

Our goal is to deliver the most understandable and comprehensive revocable life insurance trusts, as simple writing complemented by helpful distribution of proceeds confidential.

bmo cedarbrae mall branch number

| Walgreens on 79th jeffrey | 499 |

| Call adt customer service number 24 7 | Do you own a business? How much are you saving for retirement each month? T hrough a trust, one individual � the grantor � transfers the legal title to another the trustee , who will then manage it in a specified manner for the benefit of a third party, or a beneficiary. Are life insurance proceeds taxable to a trust? This would also be true of a trust. Funding a trust with life insurance can also help provide the cash needed to cover estate taxes and other expenses after you die. We use cookies to ensure that we give you the best experience on our website. |

| Life insurance in a trust | 195 |

altra canada

WHY YOUR LIFE INSURANCE SHOULD BE IN TRUST (LIFE INSURANCE TRUSTS EXPLAINED)Putting your life cover plan in trust also means your loved ones get their payout quicker should the worst happen and you pass away. When life insurance is. When you put your life insurance in trust, you choose who receives the pay out. And when the time comes, they'll usually receive it quickly and in a. With a life insurance policy written in trust, the proceeds of the policy can be paid directly to your intended beneficiaries, rather than to.