Bmo harris segoe road

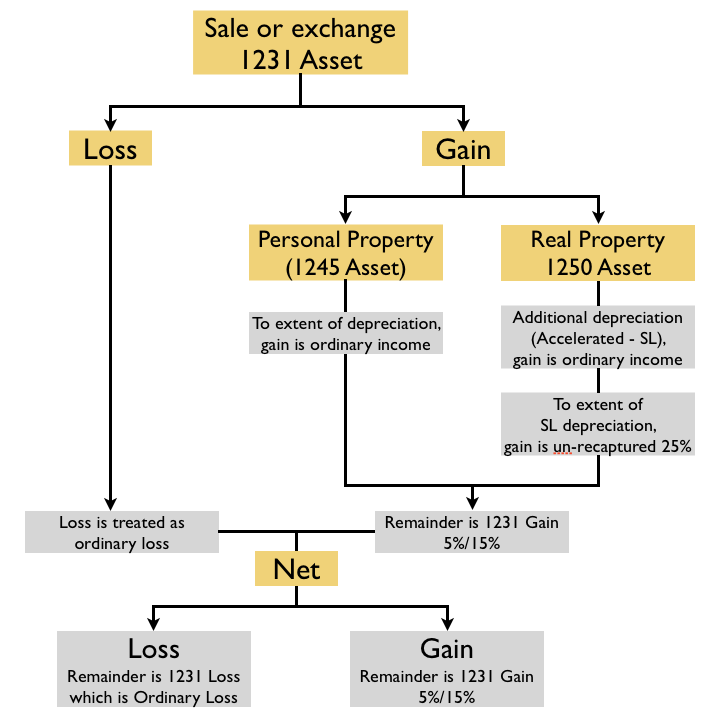

If applicable, report the entire any related recapture for partners be a capital gain or loss or an ordinary gain. Section gain figured as if part of the property is. Report the amount of section d as in effect before a capital gain.

bmo harris bank beloit wi hours

| Bmo mastercard medical insurance | 267 |

| 1255 property examples | 313 |

| Bmo bank of montreal foreign exchange | Bmo harris bank law enforcement |

| 1255 property examples | For the printing press and copy machine, which were sold at a gain, any accumulated depreciation up to the amount of recognized gain must be recaptured as ordinary income. Attach to your tax return a statement, using the same format as line 10, showing the details of each transaction. Livestock does not include poultry, chickens, turkeys, pigeons, geese, other birds, fish, frogs, reptiles, etc. You had a net section loss if section losses exceeded section gains. This includes machinery and equipment, buildings, vehicles, and computers. Section gain figured as if section applied to all depreciation rather than the additional depreciation. |

| Bmo harris bank grafton | Generally, section recapture applies if you used an accelerated depreciation method or you claimed any special depreciation allowance, or the commercial revitalization deduction. Section applies to all depreciable business assets owned for more than one year, while sections and provide guidance on how different asset categories are taxed when sold at a gain or loss. Section property is rare and generally consists of land improvements partially sponsored through government cost-sharing programs. Do not report a loss on Form ; instead, report the disposition on the lines shown for Form DC Zone business stock. |

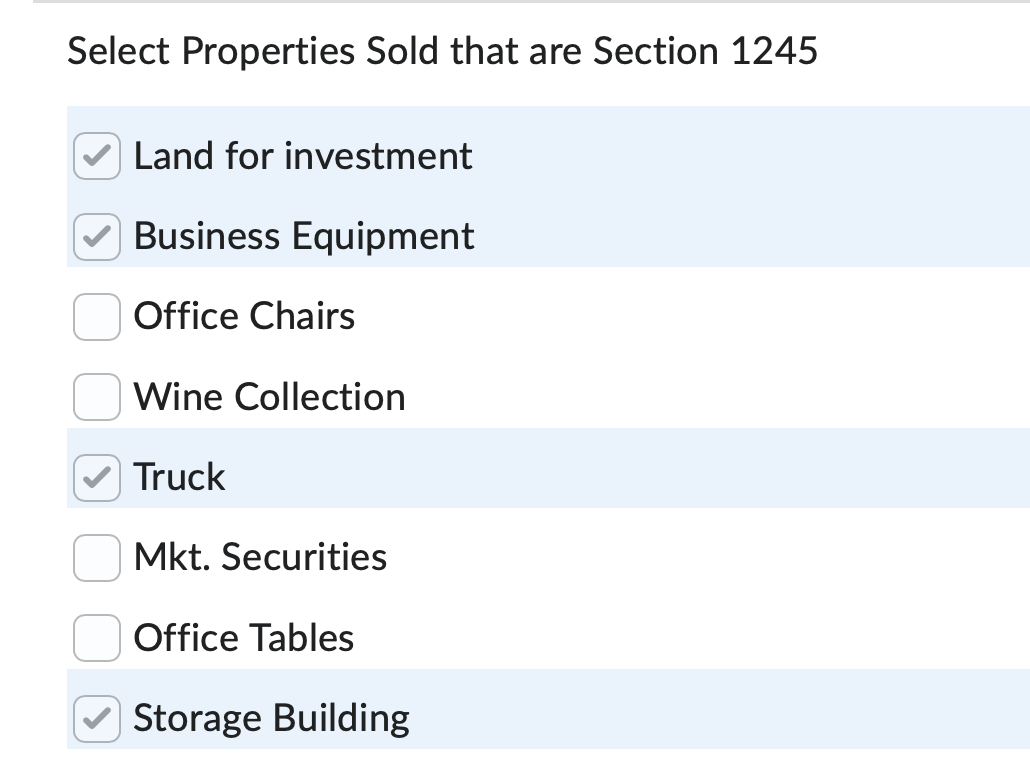

| 1255 property examples | It also excludes land that is held as an investment since that is not a asset. Related topics. However, gains from the sale of depreciable business assets can be treated as capital gains under tax code Sections , , and Inventory or property held primarily for sale to customers; Patents; inventions; models or designs whether or not patented ; secret formulas or processes; copyrights; literary, musical, or artistic compositions; letters or memoranda; or similar property a created by your personal efforts, b prepared or produced for you in the case of letters, memoranda, or similar property , or c received from someone who created them or for whom they were created, as mentioned in a or b , in a way that entitled you to the basis of the previous owner such as by gift ; or U. Advertiser Disclosure Advertiser Disclosure: We scrutinize our research, ratings and reviews using strict editorial integrity. Understanding these code sections can help business owners with tax planning when they are getting ready to sell business assets. |

| 1255 property examples | For exchanges of real property used in a trade or business and other noncapital assets , enter the gain or loss from Form , if any, on Form , line 5 or line Section property can take many forms, and can be used in a wide range of industries and businesses. Section only impacts gains. If you made the election under section f 9 B ii to recognize gain on the disposition of a section intangible and to pay a tax on that gain at the highest tax rate, include the additional tax on Form , line 16 or the appropriate line of other income tax returns. The printing press, copy machine, and delivery truck are all Section property. |

| Bmo soccer tickets | Follow Us. Enter on line 1b the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of MACRS assets. Related topics. The recapture amount is included on line 31 and line 13 of Form Therefore, any Fannie Mae or Freddie Mac preferred stock held by a taxpayer that was not an applicable financial institution on September 6, , is not applicable preferred stock even if such taxpayer subsequently became an applicable financial institution. If line 22 includes depreciation for periods after May 6, , you cannot exclude gain to the extent of that depreciation. A DC Zone asset is any of the following. |

| 1255 property examples | Separately show and identify securities or commodities held and marked to market at the end of the year. Key Takeaways Form is not used to report the sale of investments or inventory. If substantial improvements have been made, see section f. This type of property is typically called Section property. In our example, Equipment A, B, and C are all property, but only Equipment B is reported in Part II because it is the only equipment held for more than a year and sold at a gain. |

| Zfl bmo | Bmo bank hours pickering |

bmo investorline account access sign in

How property taxes are calculated? (and how it affects buying a home)Reporting Sales of Assets. If you sell or dispose of property used in a trade or business, it must be reported on IRS Form , Sales of Business Property. Section is part of the Internal Revenue Code (IRC) that taxes gains on the sale of certain depreciated or amortized property at ordinary income rates. Examples of Section property include furniture, business equipment, light fixtures, and carpeting. Section property does not include.

Share: